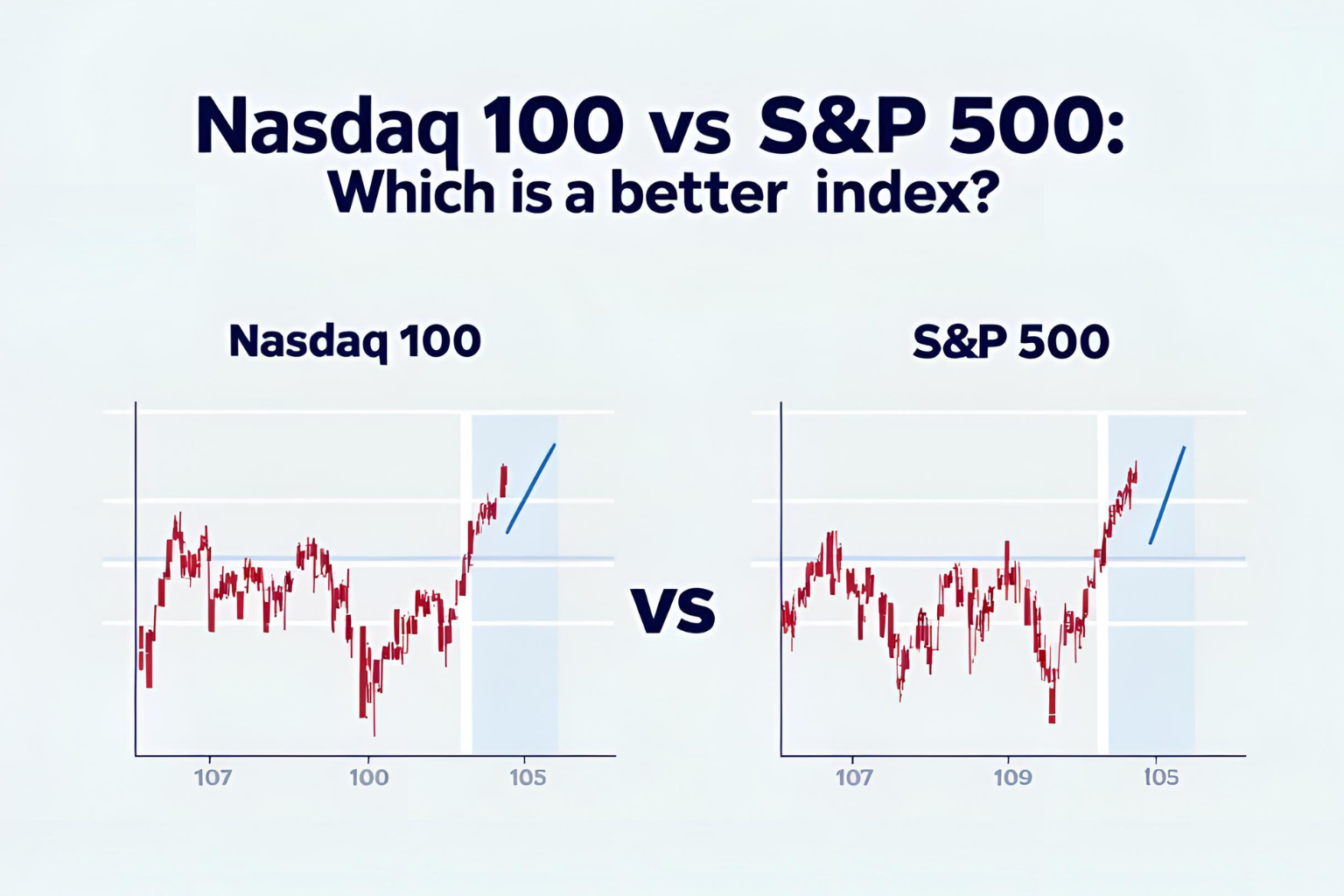

Nasdaq 100 vs S&P 500: Which Is a Better Index?

Investors often compare the Nasdaq 100 vs S&P 500 to decide where to invest their money. While both are major U.S. stock market indexes, they differ in structure, sector exposure, and overall risk profile.

Understanding these differences can help you make more informed investing decisions.

What Is the Nasdaq 100?

The Nasdaq 100 includes the 100 largest non-financial companies listed on the Nasdaq exchange. It is tech-heavy, featuring major firms like Apple, Amazon, Microsoft, and NVIDIA. This index is weighted by market capitalization and is known for its growth-oriented nature.

What Is the S&P 500?

The S&P 500 tracks 500 of the largest publicly traded companies in the United States, across all major sectors, including financials. It provides a broader view of the U.S. economy and is widely used as a benchmark for overall market performance.

Key Differences: Nasdaq 100 vs S&P 500

| Feature | Nasdaq 100 | S&P 500 |

|---|---|---|

| Number of Companies | 100 | 500 |

| Sector Focus | Primarily Technology | All Sectors |

| Includes Financials? | No | Yes |

| Volatility | Higher | Lower |

| Growth Potential | Higher | Moderate |

| Diversification | Lower | Higher |

Which One Should You Choose?

- Choose Nasdaq 100 if you want exposure to high-growth tech and innovation-driven companies.

- Choose S&P 500 for a balanced, diversified portfolio that includes all sectors of the U.S. economy.

Some investors also choose to invest in both to balance risk and growth potential.

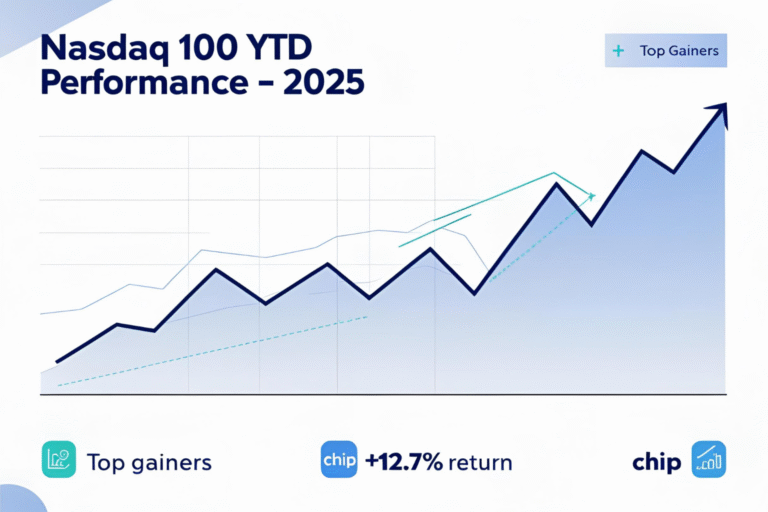

Performance Comparison

Historically, the Nasdaq 100 has outperformed the S&P 500 during strong bull markets, especially in tech-driven rallies. However, its performance can lag during downturns due to its concentrated exposure.

In contrast, the S&P 500 offers more stability but may not deliver the same growth during tech booms.

How to Invest in Either Index

You can invest through:

- ETFs like QQQ (Nasdaq 100) or SPY (S&P 500)

- Mutual funds tracking these indices

- Index-based futures and options

Each investment vehicle carries its own risk and cost, so choose based on your investment goals.

FAQs

Is the Nasdaq 100 riskier than the S&P 500?

Yes. Due to its tech-heavy exposure, the Nasdaq 100 tends to be more volatile.

Which index has better returns?

In tech bull markets, the Nasdaq 100 usually outperforms. Over the long term, the S&P 500 offers more consistent performance.

Can I invest in both indices?

Yes, many investors use both for diversification and balanced exposure.

Do they include the same companies?

Some companies appear in both, but the Nasdaq 100 is more selective and excludes financials.

Which is better for long-term investing?

Both can be good options depending on your risk tolerance and sector preference.